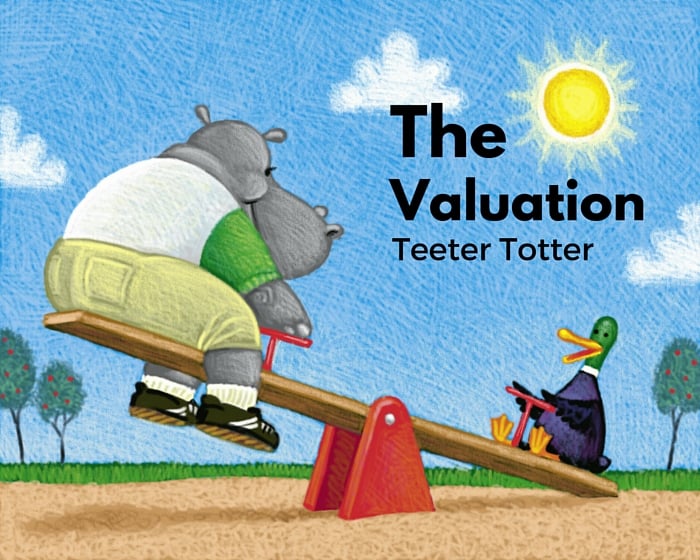

Playing on the Valuation Teeter Totter…

The Teeter-Totter (or Seesaw) is believed to date back before recorded history. Even today, as it remains one of the simplest pieces of playground equipment for kids to entertain themselves on, some form of it is a staple on most playgrounds. It is a basic law of physics in action when you place a long rigid plank over a pivot point, for one side to go down the other side must go up. And, we all know what happens with there is too much or too little weight on one end!

In a similar fashion, one day your business will be viewed on a Valuation Teeter-Totter and when that day comes there is one direction you do not want it to tilt.

Let’s face it, whether you plan for it to happen in the next year or 20 years from now, at some point you are going to either sell, transition, or simply shut down your business. If you plan to just shut your business down, then you can stop reading. If however, you plan to one day sell or transition your business you probably should understand how the Valuation Teeter-Totter works.

The two checks…

When the day comes to sell your business, most business owners have one check in mind, that is the amount of the check that will be written by the buyer for all the blood, sweat, and equity that you, the business owner has put into the business. What you have spent (often) the majority of your life building. Your expectations are high, you have worked hard and you expect to be rewarded for all that you have done. It is time to pass the torch and that check is your pat on the back for a job well done. The seller’s view is there is one check written.

But for the buyer it is much different. They not only see the dollar amount you are asking for the business; but they have to be prepared to financially keep the great business you have built running. They have to look at the infusion of capital that will be required. Payroll for the employees, operating equipment, inventory, property/rent, insurance, and the utilities all will require capital. At the end of the day…or at the end of the month how much money does your business need to keep operating? Often the business needs cash to continue operating.

The buyer’s view is two checks are written. The one they write to you the seller and the one they write to fund the operation of the business. The buyer is writing two checks.

Playing on the Valuation Teeter-Totter…

Now let’s place these two checks on each end the Valuation Teeter-Totter; on one end the check for you, the business owner. And, on the other end the check to fund the operation of the business. Each check’s weight is in relation to its dollar amount. If the buyer only has limited funds (which is often the case), it is easy to see what happens when more capital is required to fund the operation of the business; the money has to come from somewhere. Often the check for you, the seller, decreases and the Valuation Teeter-Totter unfortunately doesn’t tilt in your favor. The buyer may even want to pay you more for your business, but because he/she has limited resources available they are unable to.

Tilting the Teeter-Totter in your favor…

The best way to ensure the Valuation Teeter-Totter tilts in your favor is to reduce the outflow of cash that doesn’t have revenue coming in to offset it. Some places to start would be reviewing your gross profit margins and shortening your billing cycles. And if your business has inventory; are your levels in-line with sales?

At the end of the day, a buyer is simply going to place more value on a business requiring less capital infusion at the time of purchase, because it is an indicator that the business self-funds a large percentage of its overhead with well managed inventory levels, margins, and billing practices. And when more value is placed on the business the Valuation Teeter-Totter tilts in favor of you the business owner.

What do you think? How would your business tilt on the Business Valuation Teeter-Totter? Are you sure? Want to see how your business compares to others in your industry? As always, we value any comments and feedback.

Chris Steinlage, Kansas City Business Coach