Does your business have a Salary Cap?

With summer winding down, it’s time for the NFL to kick off. So…do you have a salary cap for your business?

You don’t? Maybe you should…Greg Crabtree is the author of Simple Numbers, Straight Talk, Big Profits and one of the great ideas in his book is the recommendation that every business should self-impose a salary cap just like the one that NFL teams deal with.

Don’t think about it in terms of cutting or controlling costs – it’s really a focus on labor productivity. How much output, revenue, benefit do you get from each dollar you spend on labor? As a business owner, your single biggest expense is likely payroll – the salary that you pay to your employees (and yourself) or the money paid out to sub-contractors or vendors for labor. If you want to impact your overall success – your profitability, then you need to start by looking at your labor productivity as the biggest component (since it’s the biggest expense).

How to calculate your Salary Cap

Based on the way the media talks about the NFL salary cap, you would need a team of PhD’s and a big chunk of super computer time to calculate any given team’s salary cap position. Fortunately it’s way easier to calculate your salary cap as a friendly neighborhood business owner. Here’s the breakdown:

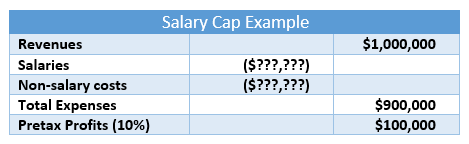

Let’s assume (to keep the math easy) that your business generates $1M in revenue. And that you have determined that you need a 10% profit from the business (after paying yourself a reasonable market wage of course). ***Note this assumption of a predetermined profit and paying yourself a market wage is another really important concept for many business owners, but I’ll save that for another post.

With those assumptions in mind, you can back into what your total expenses look like – leaving the question of which expenses are salary vs. non-salary.

Your non-salary costs should be fairly easy to calculate – these are all of your fixed costs…stuff like rent, utilities, insurance, etc. This would also include your cost of goods (materials, etc.) for $1M worth of products if you have that kind of business.

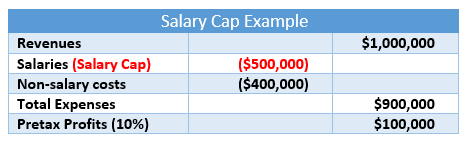

Let’s assume that your non-salary costs are $400,000…

As you can see, that means your salary cap is $500,000, which includes all labor costs – including what you pay yourself.

If your current payroll expense is more than $500,000 (and the other numbers are correct) then you’re not going to hit your profit target and your business is at risk. Which gets us back to the labor productivity idea – the key is to generate $1M worth of revenue from that $500,000 of labor and if you want to be more profitable than 10%, then you either need to cut your salary expenses without impacting your productivity (do more with less) or grow your revenue without increasing your salary (again do more with less…or technically the same in this case).

To bring it back to the NFL comparison – when the Chiefs cut a high priced veteran player and replace them with a rookie, they are hoping to increase their labor productivity by getting similar production and reducing their cost at that position. That allows them to invest that money somewhere else within the team.

Implications for Business Owners and growth

Odds are that you haven’t thought about a salary cap before this – but it’s a great way to model where you are with your business and identify if you’re getting what you need out of your team in order to really be successful.

For growth you can use this model to figure out what would be needed for a 15% profit at your current salary cap and hold off on hiring until you hit that point. As you grow without hiring, things will become challenging and at some point you’ll make that next hire, which bumps up your salary cap – and maybe drops you back to your 10% profit level for awhile. Bouncing back and forth between 10% and 15% gives you some guidance and guardrails on how to grow without putting your business at risk or in the red.

If you’re not where you want to be in terms of profitability – what would your salary cap need to be in order to get you the outcome that you want? Who do you need to cut from the team? Or who’s not performing? It’s a tough analysis to do but it could mean the difference between struggling or winning.

This is a simple idea (which is what I really like about it). What do you think? Could this model be helpful for your business right now? Are you getting good labor productivity from your team? Do you know? I’d love to hear your thoughts – share them in the comments below.

Shawn Kinkade Kansas City Business Coach